Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts. Therefore I believe I am not entitled to the 3 million baht residence visa and will have to take 10 million into the country.

Pdf Impact Of Tax Knowledge Tax Compliance Cost Tax Deterrent Tax Measures Towards Tax Compliance Behavior A Survey On Self Employed Taxpayers In West Malaysia Semantic Scholar

Malaysia adopts a territorial scope of taxation where a tax-resident is taxed on income derived from Malaysia and foreign-sourced income remitted to Malaysia.

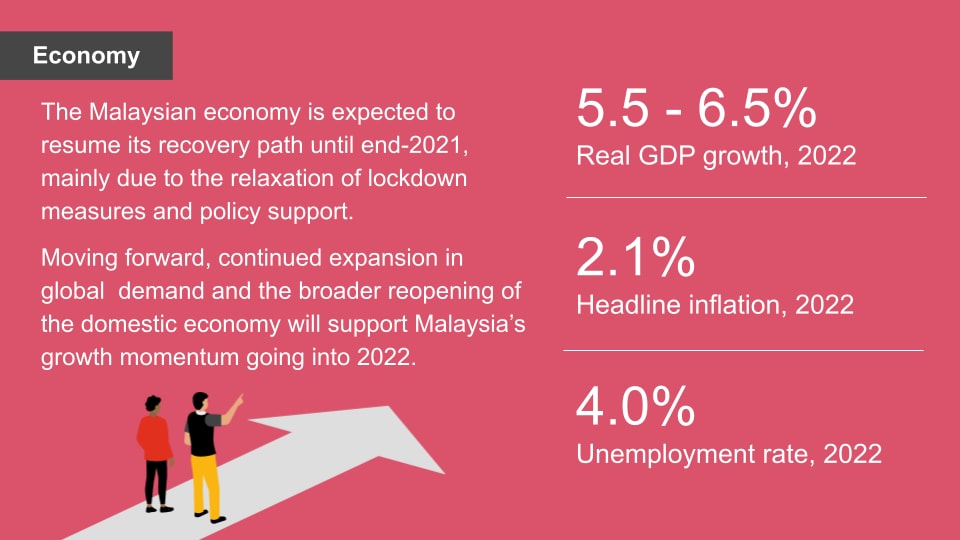

. The new policy will be retroactive and will apply from January 1 2020. In Malaysia corporations are subject to corporate income tax real property gains tax goods and services tax GST and etc taxes. The long-term average.

Tax invoices sets out the information requirements for a tax invoice in more detail. Find out which income can be exempted from income tax in Malaysia for 2022. For example a company that closes its accounts on 30 June of each year is taxed on income earned during the financial year ending on 30 June 2022 for year of assessment 2022.

Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees. In other words resident and non-resident organisations doing business and generating taxable income in Malaysia will be taxed on income accrued in or derived from Malaysia. GSTR 20131 Goods and services tax.

However foreign-sourced income of all Malaysian tax residents except for the following subject to conditions to be announced which is received in Malaysia is no longer be exempted. Taxable and non-taxable sales. The yearly amount can be fully deducted regardless of whether the taxpayer had an income every month.

Types of income under section 131 of the Act states that the gross income of an employee concerning gains or profit from an employment includes-. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. In high-income countries the highest tax-to-GDP ratio is in Denmark at 47 and the lowest is in Kuwait at 08 reflecting low taxes from strong oil revenues.

Find Out Which Taxable Income Band You Are In. IMoneymy Learning Centre All Categories. I will have completed 1 year of teaching with a taxable income from 2019 as 280000 baht.

But from 01072017 to 31122014 the house was. Women who returned to work on or after 27 October 2017 can apply for income tax exemption if they were away from the workforce for at least two years. I lived in thailand 2006 - 2017 on a non img retirement visa.

Therefore a resident taxpayer will be allowed to deduct from his taxable income US475 VND 11 million as compared to US387 VND 9 million previously. This means I can expect to pay approx 14000 baht in order to. What are the types of income which are taxable and subject to Monthly Tax Deduction MTD or in Bahasa Malaysia Potongan Cukai Berjadual PCB.

On average high-income countries have tax revenue as a percentage of GDP of around 22 compared to 18 in middle-income countries and 14 in low-income countries.

Corporate Income Tax In Malaysia Acclime Malaysia

What Is The Importance Of Getting Diploma In Accounting Bookkeeping Bookkeeping Services Tax Advisor

Malaysia Direct Tax Revenue Statista

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

Corporate Income Tax In Malaysia Acclime Malaysia

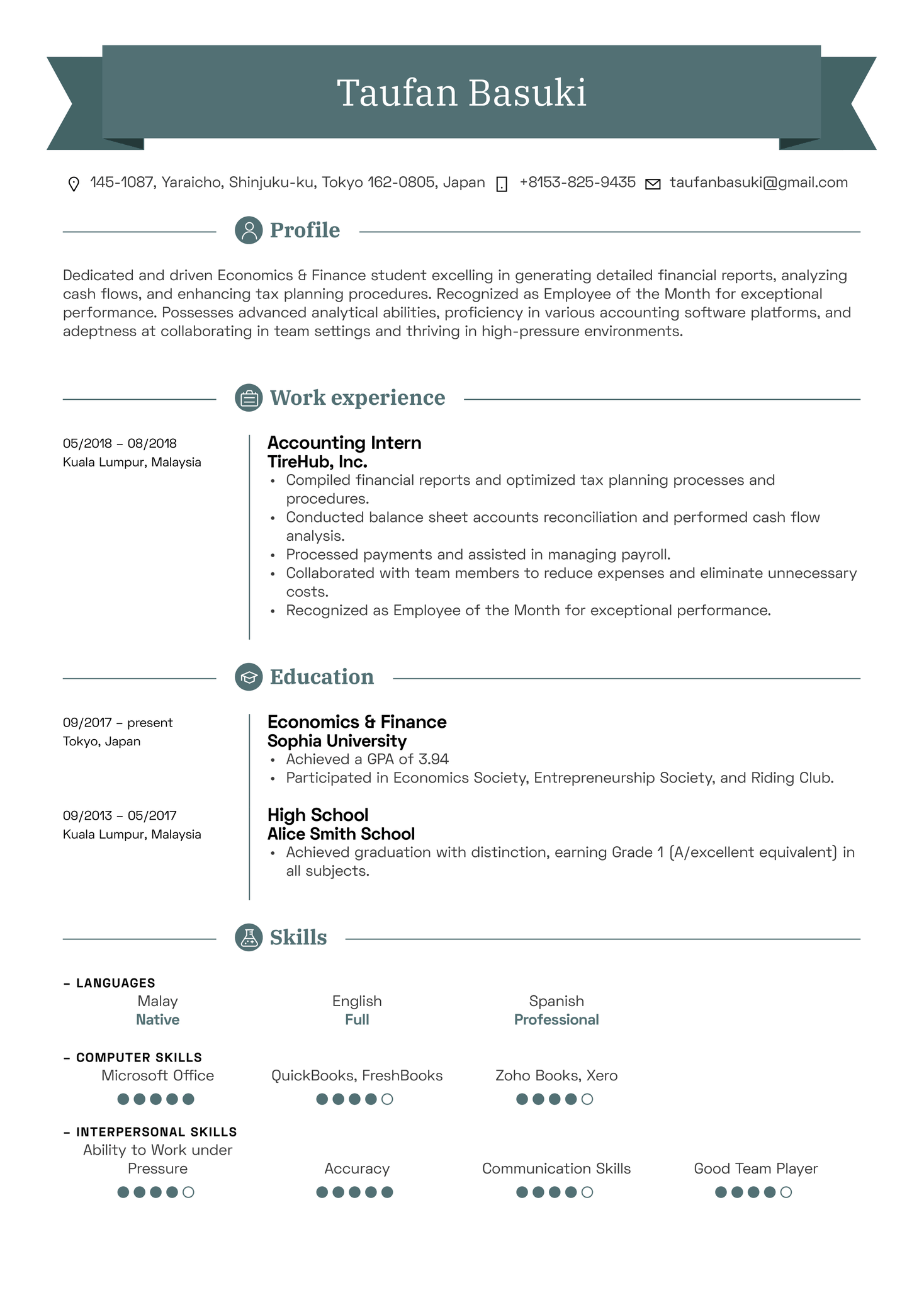

Accounting Intern Resume Sample Kickresume

Qi Group Of Companies Is The World S Fastest Growing Online Shopping And Business Community Community Business Group Of Companies Travel And Leisure

Malaysia Special Foreign Sourced Income Program Ends Kpmg United States

Malaysia Market Profile Hktdc Research

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Common Reporting Standards Impact In Malaysia And Asean Asia Law Portal Retirement Fund Financial Information Financial Institutions

Malaysia Tax Revenue 2019 Statista

Arena Multimedia Lahore Center 8 Days Adobe Photoshop Professional Course With Raheel Ahmed Baig On 7th Janua Arena Multimedia Network Marketing Solutions

Malaysia S 2018 Budget Salient Features Asean Business News

Arena Multimedia Lahore Centers To Celebrate Quaid S Birthday Arena Multimedia Proudly Offers 25 Discount Between 24t Arena Multimedia Scholarships Admissions